Teaming with Regulators Since 1987

Benefits of Partnering with The INS Companies

Regulator Only

We serve regulators only, eliminating conflicts of interest with

industry.

Data Security

We take security seriously and utilize the highest grade technology

to maintain data securely for our clients and the industry.

Innovation

Our team is continuously acquiring new skills and looking for ways

to complete tasks more efficiently and effectively.

Training

We provide training to your staff on-site, via webinars or off-site.

- 1

Tradition and Excellence

The INS Companies, a group of regulatory consulting firms, consists of over 200 regulatory professionals dedicated to assisting regulators exclusively since 1987. The INS Companies provide assistance and consultation to regulators in virtually all areas of regulation.

The INS Companies Leadership

Alan Shaw

CEO and Chairman of the Board

Annette Knief

President and Managing Partner

Ryan Shaw

Partner

Our Clients

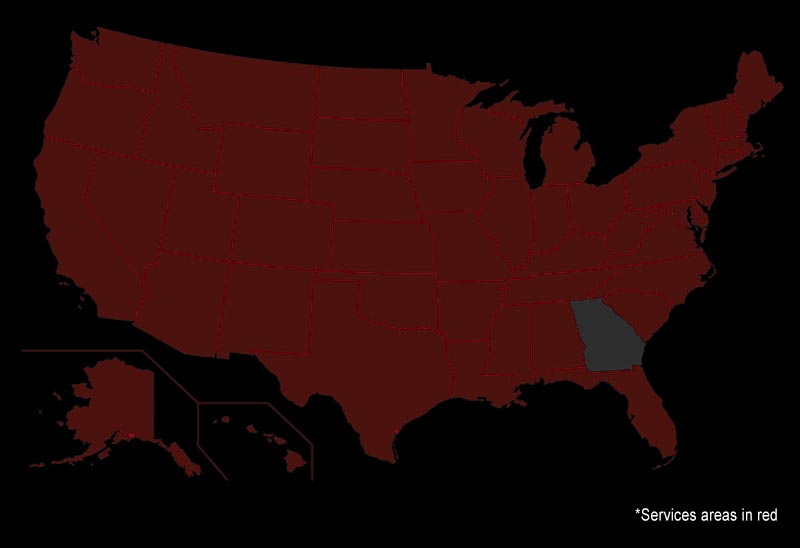

The INS Companies have served clients in forty-nine states, the District of Columbia, and the United States Territories of Puerto Rico, Guam, and the US Virgin Islands. The firm has guided several clients through the process of obtaining first time accreditation and assisted numerous others in maintaining accreditation status. In addition, The INS Companies have provided services to federal regulatory agencies.

©

2026

The INS Companies. All rights reserved.